Montpelier Budget: Tax Increase, Staff Cuts, Fire Truck Vote

Montpelier residents have been closely following the city’s budget discussions since they commenced in November. Initially, there were concerns that the municipal tax rate would skyrocket by up to 24% in the upcoming fiscal year starting on July 1, 2026, if expenses were not curbed. Finance Director Sarah LaCroix candidly expressed her apprehension to the city council, stating, “I expect that the FY26 budget process will be the most difficult in recent history.”

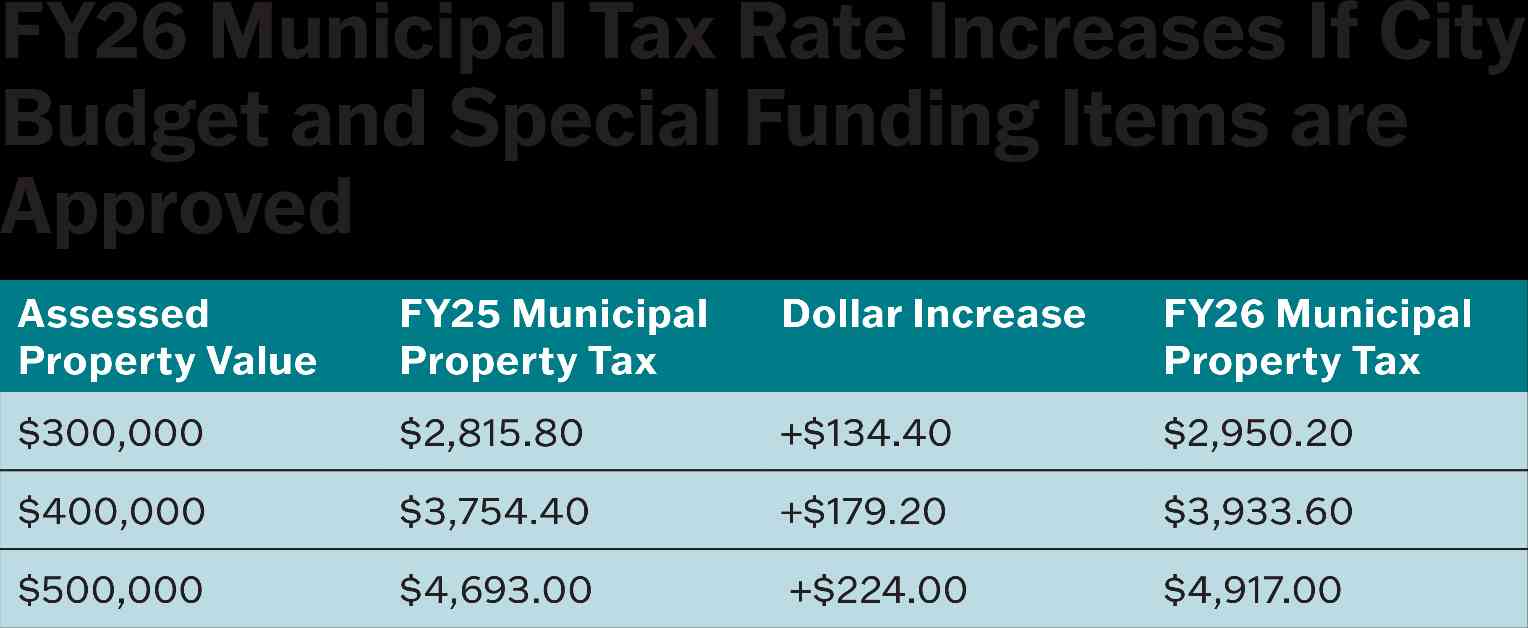

After rigorous deliberations and significant cuts, which involved the elimination of multiple staff positions, the anticipated municipal tax rate increase has been revised to a more palatable 4.77%. However, this projection hinges on the approval of all ballot items during Town Meeting Day on March 4. While this adjustment is a relief, it still surpasses the inflation rate, signaling continued financial strain for residents.

The average Montpelier home, assessed at $370,000, can expect to see an average municipal tax rate hike of $165.76. It’s worth noting that this figure does not encompass the anticipated uptick in school taxes, which constitute a significant portion—about 58%—of total tax bills in Montpelier.

City Manager Bill Fraser presented a budget proposal to the council that would have resulted in a 5.9% tax increase if all ballot items were approved. This proposal included a series of austere measures, such as staff cuts in various departments. Positions on the chopping block ranged from the Department of Public Works to Parks and Recreation, with notable eliminations like the Americorps and Youth Conservation Corps program, crucial for park maintenance during the summer months.

In a bid to further alleviate the strain on property taxes, the city council opted to endorse a budget that necessitated additional spending reductions and staff layoffs. Notable cuts included the city manager’s executive assistant role and a vacant 17th police officer position. However, there is a glimmer of hope for the latter, as some councilors have expressed willingness to fund the position should a suitable candidate be identified.

Beyond the city and school budgets, voters in Montpelier will face an array of funding requests during the upcoming Town Meeting Day. These requests span a spectrum of community needs, from a substantial allocation for the Kellogg-Hubbard Library to modest sums earmarked for Central Vermont Home Health and Hospice, as well as Mosaic Vermont.

Additionally, voters will be tasked with deciding on crucial financial matters, including a proposal to allocate $134,150 to the Montpelier Community Fund—a vital resource that supports nonprofits and artists in the community. Established by the city council in 2012 to streamline funding processes, the fund has historically been integrated into the city budget.

In a move geared towards enhancing public safety infrastructure, voters will also be called upon to authorize borrowing up to $2.2 million for the acquisition of an aerial ladder fire truck. Furthermore, the prospect of implementing a 1% local option sales tax, which could potentially generate up to $600,000 in fresh revenue for the city, will be put up for approval.

As the community braces for these pivotal decisions, the overarching goal remains striking a delicate balance between fiscal responsibility and meeting the diverse needs of Montpelier residents. The outcome of these deliberations will undoubtedly shape the city’s trajectory in the coming year, underscoring the importance of civic engagement and informed decision-making in safeguarding the community’s welfare.