The Burlington Cathedral Tax Dispute: A Clash of Faith and Finances

In the heart of Burlington lies the Cathedral of the Immaculate Conception, a building steeped in history and controversy. Since 2018, this religious edifice has stood silent and empty, closed off from parishioners and the public alike. But behind its closed doors, a battle is brewing between the City of Burlington and the Catholic parish that owns the cathedral.

The issue at hand? Taxes. The city claims that the cathedral no longer qualifies for tax-exempt status, a privilege typically granted to religious organizations. However, the parish vehemently disagrees, arguing that until the cathedral is demolished, it should not be subject to property taxes.

This clash of faith and finances comes on the heels of a two-year court battle that saw the parish emerge victorious in its quest to demolish the cathedral. But as one conflict ends, another takes its place, leaving both parties at a standstill with no clear resolution in sight.

A Church Closed, A City Divided

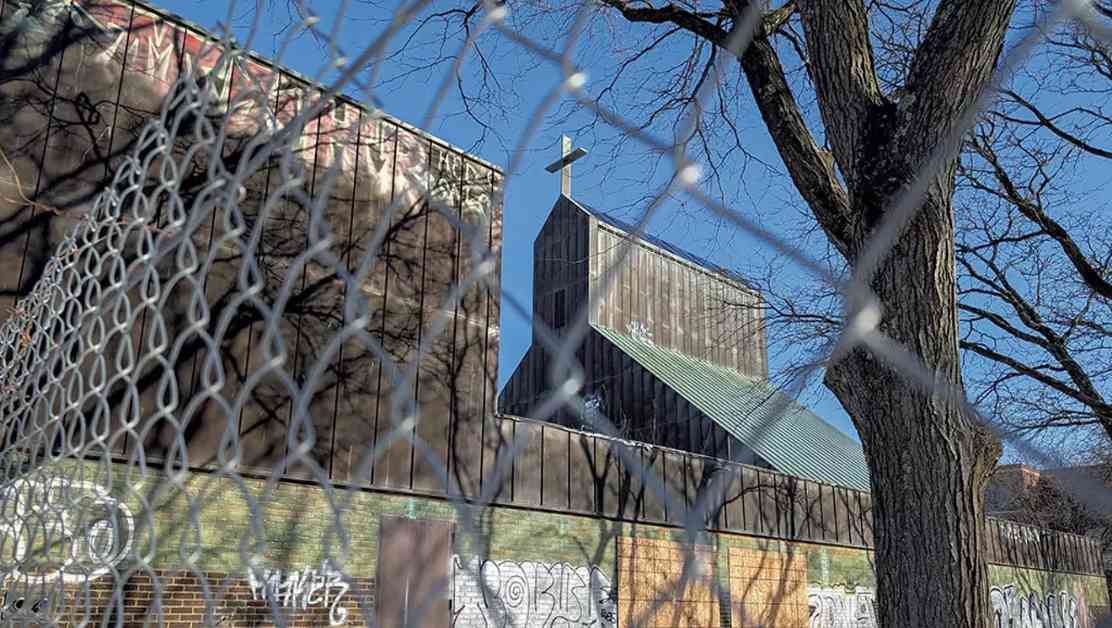

The Cathedral of the Immaculate Conception, built in 1977, closed its doors in 2018 due to financial constraints. Since then, the parish has struggled to maintain the building, eventually listing it for sale in 2019. With a price tag of $8.5 million, the property has remained vacant, its once-lush grounds now fenced off from the public.

In 2022, the parish sought a permit to demolish the cathedral, a move that sparked outrage among preservationists. Led by activist Devin Colman, these groups questioned the tax-exempt status of the cathedral, arguing that a closed, unused building should not enjoy the same benefits as an active church.

City officials weighed in on the matter, with City Assessor Joe Turner conducting a thorough analysis of the situation. Citing a three-part test that determines a property’s tax-exempt status, Turner found that the cathedral no longer met the criteria for exemption. Unless the parish could prove otherwise, the property would be subject to property taxes, amounting to over $100,000 in the coming fiscal year.

A Taxing Dilemma: Past Precedents and Present Predicaments

The case of the Cathedral of the Immaculate Conception is not unique. In nearby Winooski, a similar situation unfolded when the former St. Stephen Church was added to the tax rolls after its closure in 2020. The property, valued at nearly $500,000, generated substantial tax revenue for the city, prompting questions about the tax status of vacant religious buildings.

Attorney John Franco, representing the Burlington parish, argued that the three-part test used by the city assessor was not applicable to the cathedral. Citing laws that exempt church buildings from taxes, Franco maintained that as long as the cathedral stood, it should remain tax-exempt. The impending demolition, he claimed, was a religious act that further solidified the cathedral’s status as a religious structure.

As the dispute continues to unfold, both sides remain entrenched in their positions. The parish faces the prospect of hefty tax bills, while the city grapples with the complexities of tax law and religious exemptions. The fate of the Cathedral of the Immaculate Conception hangs in the balance, its future uncertain as the city and the parish navigate this challenging terrain.

A Divisive Issue: Looking Ahead and Seeking Resolution

The deadline for a final decision looms large, with the city required to compile its grand list by April 1. Should the property be taxed, the parish has the option to challenge the decision through a series of appeals, potentially leading to a protracted legal battle.

As the cathedral’s fate hangs in the balance, one thing remains clear: the clash of faith and finances has left both parties at odds, grappling with complex legal and moral questions. The city of Burlington and the Catholic parish find themselves on opposite sides of a contentious debate, each vying for a resolution that aligns with their respective interests.

In the end, the fate of the Cathedral of the Immaculate Conception serves as a poignant reminder of the intersection between religion and taxation, a delicate balance that continues to spark debate and division in communities across the country. As the dispute rages on, both sides remain steadfast in their convictions, with the future of this historic building hanging in the balance.

The parishioners must now decide whether to accept the city’s decision or pursue further legal action, a choice that could have far-reaching implications for the cathedral and its legacy. Only time will tell how this contentious issue will be resolved, but one thing is certain: the clash of faith and finances has left an indelible mark on the community, raising questions that go to the heart of our values and beliefs.