Seventy years ago, a small group of community-minded individuals in Vermont had a vision: to create a financial institution that truly served the people. That vision became Vermont Federal Credit Union, which has since grown into a cornerstone of the local community, now serving over 100,000 members with assets exceeding $1.3 billion. What began as a modest cooperative has evolved into a testament to the power of community-driven finance.

Vermont Federal Credit Union’s longevity and growth underscore its commitment to the region. The credit union’s success is not just measured in numbers, but in the countless lives it has touched through personalized service, affordable financial products, and a genuine dedication to improving the community. From helping first-time homebuyers to supporting local businesses, Vermont Federal Credit Union has remained steadfast in its mission. As it celebrates this milestone, the institution looks forward to continuing its legacy of service and growth, reinforcing its role as a trusted partner in the financial well-being of Vermonters.

Roots in Vermont's Cooperative Spirit

Vermont Federal Credit Union’s roots run deep in the state’s cooperative spirit, a tradition that dates back to the early 20th century. The credit union movement, which emphasizes people helping people through shared financial resources, found fertile ground in Vermont’s close-knit communities. Vermont Federal Credit Union was chartered in 1952, building upon this foundation of mutual aid and community support.

According to the Credit Union National Association, Vermont is home to one of the highest concentrations of credit union members in the nation, with over 50% of the state’s population choosing this member-owned financial cooperative model. Vermont Federal Credit Union has been a significant contributor to this statistic, serving over 100,000 members across the state.

From its early days, Vermont Federal Credit Union has mirrored the state’s values of independence, resilience, and community support. The credit union’s initial focus was on serving state employees, reflecting Vermont’s strong public sector. Over the decades, it has expanded its reach, embracing the state’s diverse communities and evolving needs.

Vermont Federal Credit Union’s commitment to community service is evident in its long-standing partnerships with local organizations. The credit union has consistently supported initiatives that promote financial literacy, community development, and social welfare. This dedication to community service has become a cornerstone of Vermont Federal Credit Union’s identity, setting it apart as a trusted financial partner.

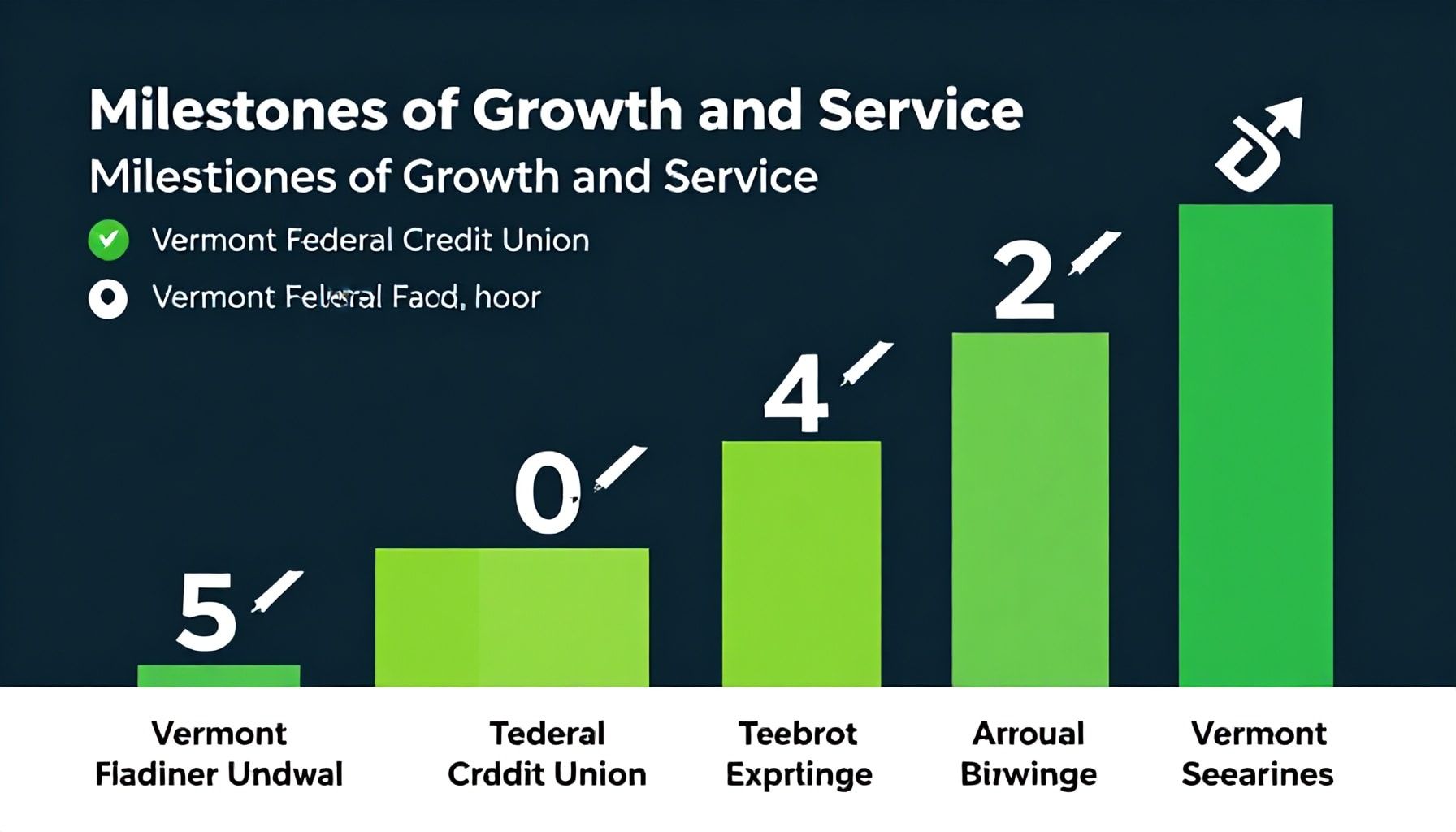

Milestones of Growth and Service

Vermont Federal Credit Union has reached an impressive milestone, marking seven decades of dedicated service to its community. Founded in 1952, the institution has grown from a small cooperative to a robust financial partner serving over 50,000 members across the state. This growth reflects the credit union’s commitment to providing personalized financial services tailored to the unique needs of Vermonters.

Throughout its history, Vermont Federal Credit Union has played a pivotal role in fostering financial literacy and stability. The institution has consistently introduced innovative programs to educate members on smart financial practices. According to financial experts, such initiatives are crucial in empowering individuals to make informed decisions about their money.

In the 1980s, the credit union expanded its services to include business loans, supporting local entrepreneurs and contributing to the state’s economic development. This move underscored its dedication to community growth and prosperity. Today, Vermont Federal Credit Union continues to adapt and evolve, ensuring it remains a trusted ally for generations to come.

Celebrating 70 years of service is a testament to the enduring trust and loyalty between the credit union and its members. The institution’s journey is marked by resilience, adaptability, and an unwavering commitment to community service. As it looks to the future, Vermont Federal Credit Union remains steadfast in its mission to serve and support the people of Vermont.

Membership Benefits Beyond Banking

Vermont Federal Credit Union’s commitment to its members extends far beyond traditional banking services. The credit union has cultivated a robust ecosystem of benefits designed to enhance members’ financial well-being and quality of life. From exclusive discounts to educational resources, Vermont Federal offers a comprehensive suite of perks that set it apart from conventional financial institutions.

One standout benefit is the credit union’s partnership with local businesses, providing members with access to special offers and discounts. These range from dining and entertainment to automotive services and retail. This initiative not only supports local commerce but also delivers tangible savings to members. According to a recent study by the Credit Union National Association, members who actively use these benefits report an average annual savings of $500.

Vermont Federal also prioritizes financial education, offering workshops and seminars on topics such as budgeting, home buying, and retirement planning. These resources empower members to make informed financial decisions. The credit union’s financial literacy programs have been recognized by industry experts for their effectiveness in promoting financial health.

Additionally, Vermont Federal provides members with access to a 24/7 financial wellness platform. This online tool offers personalized advice, financial calculators, and articles on a wide range of financial topics. The platform is designed to be user-friendly, ensuring that members can easily navigate and utilize its resources.

Through these initiatives, Vermont Federal Credit Union demonstrates its dedication to serving its members and the broader community. The credit union’s innovative approach to membership benefits reflects its enduring commitment to excellence and member satisfaction.

Community Impact Through Partnerships

Vermont Federal Credit Union has long understood that community impact doesn’t happen in isolation. The institution has cultivated strategic partnerships with local organizations to amplify its service footprint. One such collaboration is with the Vermont Foodbank, where the credit union has donated over $150,000 in the past decade to combat food insecurity. These funds have helped provide more than 450,000 meals to Vermonters in need, demonstrating the power of collective effort.

Education is another area where Vermont Federal Credit Union has made significant strides through partnerships. By teaming up with local schools and colleges, the credit union has implemented financial literacy programs that have reached over 5,000 students annually. According to a report by the National Endowment for Financial Education, such programs are crucial in equipping the next generation with essential money management skills.

In the realm of economic development, Vermont Federal Credit Union has partnered with the Vermont Small Business Development Center. This collaboration provides aspiring entrepreneurs with access to capital, mentorship, and resources. The credit union’s involvement has helped launch over 200 small businesses in the past five years, contributing to the state’s vibrant economic landscape.

These partnerships underscore Vermont Federal Credit Union’s commitment to community service. By leveraging its resources and expertise, the institution continues to make a tangible difference in the lives of Vermonters, one partnership at a time.

Innovations for Modern Financial Needs

Vermont Federal Credit Union continues to evolve with the financial needs of its members. Recently, the institution introduced a cutting-edge mobile banking app, featuring biometric login and real-time transaction alerts. This innovation reflects a broader trend in the financial sector, where digital security and convenience are paramount. According to a recent study, 65% of consumers prefer banks and credit unions that offer robust mobile banking features.

Recognizing the growing demand for financial education, Vermont Federal has launched a series of workshops focused on budgeting, saving, and investing. These sessions, led by certified financial planners, aim to empower members with the knowledge they need to make informed decisions. The credit union’s commitment to education aligns with its long-standing mission to support community well-being.

The credit union has also expanded its loan offerings to include personalized solutions for modern challenges. From green loans for energy-efficient home improvements to flexible payment plans for small businesses, Vermont Federal is adapting to the diverse needs of its members. This proactive approach ensures that the credit union remains a reliable partner in financial growth and stability.

In addition to these innovations, Vermont Federal has enhanced its customer service with 24/7 virtual assistance. Members can now access help anytime, anywhere, through live chat or AI-driven support. This round-the-clock service underscores the credit union’s dedication to providing exceptional member experiences. As the financial landscape continues to evolve, Vermont Federal Credit Union remains at the forefront, delivering innovative solutions tailored to modern needs.

Vision for the Next 70 Years

As Vermont Federal Credit Union (VFCU) looks ahead to the next 70 years, its vision remains deeply rooted in community empowerment and financial innovation. The credit union plans to expand its digital banking services, ensuring that members have seamless access to their accounts from anywhere in the world. This commitment to technological advancement aligns with a broader trend in the financial sector, where 78% of consumers now prefer digital banking options over traditional branch visits, according to a recent industry report.

VFCU also aims to strengthen its community impact through targeted financial education programs. Recognizing that financial literacy is a cornerstone of economic stability, the credit union will collaborate with local schools and organizations to provide workshops and resources. These initiatives will focus on teaching essential skills like budgeting, saving, and responsible credit use, ensuring that future generations are well-equipped to navigate their financial lives.

Sustainability is another key pillar of VFCU’s long-term strategy. The credit union plans to implement eco-friendly practices across its operations, from energy-efficient branch designs to paperless banking solutions. By reducing its environmental footprint, VFCU hopes to inspire other financial institutions to adopt similar practices, fostering a greener future for all.

With a clear roadmap for the next seven decades, Vermont Federal Credit Union is poised to continue its legacy of service and innovation. By embracing technology, promoting financial literacy, and prioritizing sustainability, VFCU will remain a trusted partner for its members and a beacon of community support in Vermont.

Vermont Federal Credit Union’s 70-year legacy stands as a testament to the power of community-focused banking, proving that financial institutions can thrive while prioritizing people over profits. For those seeking a banking partner that aligns with their values, Vermont Federal Credit Union offers a compelling alternative with its member-first approach. As the credit union looks ahead to its next seven decades, it remains committed to innovation and community engagement, ensuring its legacy of service continues to grow and evolve.